An umbrella insurance policy is a type of personal liability coverage that goes above and beyond the amount that regular home or vehicle insurance offers. Actual cash value D.

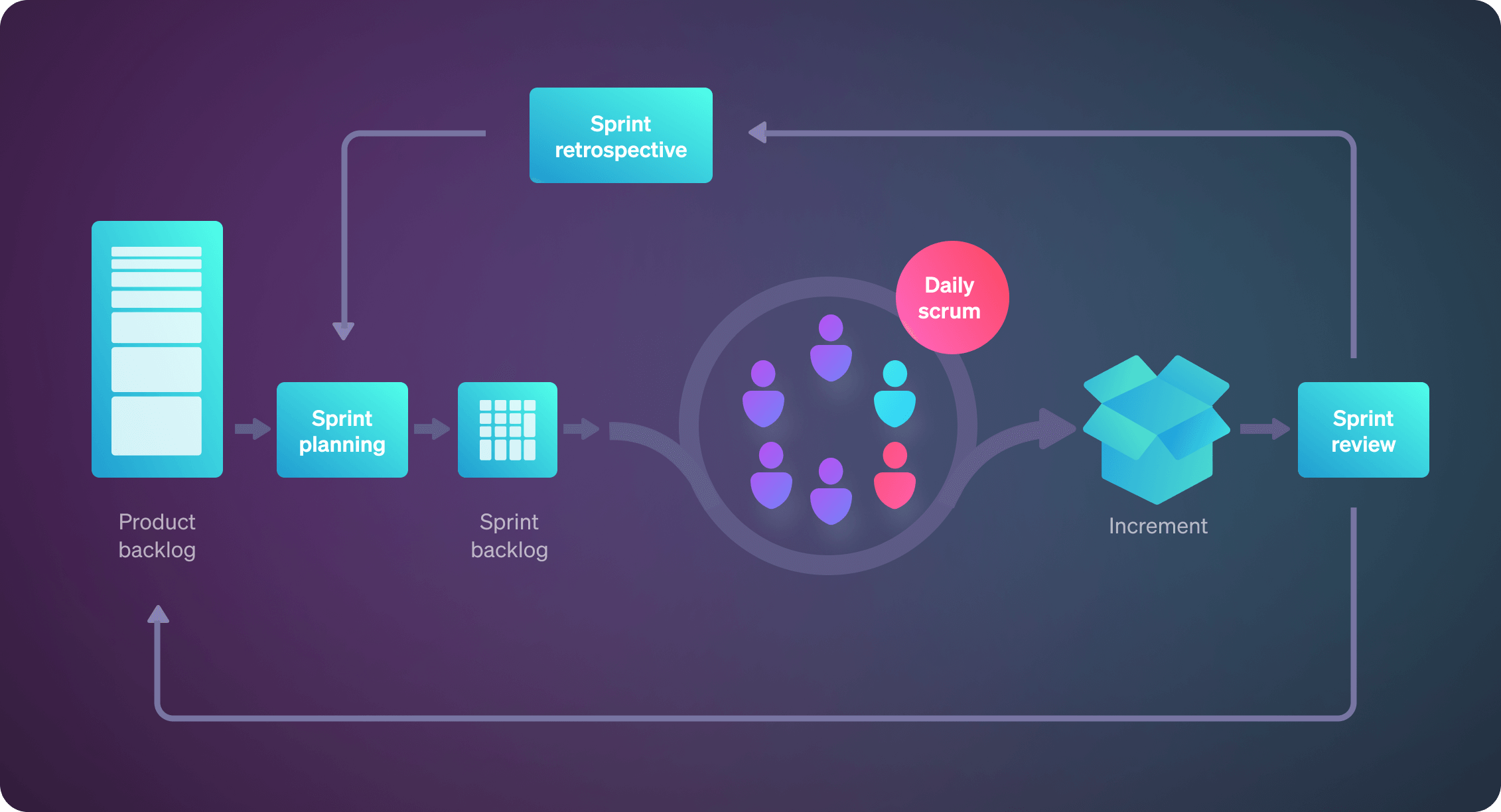

Extreme Programming Vs Scrum The Battle Of Agile Methods

THIS SET IS OFTEN IN FOLDERS WITH.

. The greater the amount of coverage the more a policy costs. Extra expense B CGL C Professional liability D Umbrella. Salvage of value The amount for which property can be sold at the end of its useful.

The premium amount increases if you decide to increase your coverage. A policy with a 5 million limit will cost more than a policy with a 1 million limit. But increasing the policy limit to 2 million and getting twice the amount of coverage will not double your cost of premium.

Yet umbrellas are a relatively new form of insurance. Which increment amount is generally used when writing Umbrella Policies. Credit also plays a part in determining the cost as it does with home and car insurance policies in Texas and other states.

Which increment amount is generally used when writing Umbrella Policies. The starting rate for umbrella insurance is generally 150 to 300 annually for a 1 million policy. The cost of an umbrella policy depends on the limits you purchase the nature of your business and your claims history.

Only a few years ago they typically had limits from 1 million to 5 million. 285 335 a year for a 2 million umbrella policy. An umbrella policys cost depends on your personal situation as highlighted above.

What type of policy can broaden coverage and increase the limits of the underlying policies. Most umbrella policies stop at 5 million but some go higher. Each additional 1 million of umbrella coverage might cost between 100 and 125 annually.

View Exam - Final Practice Quiz Answersdocx from CM 4211 at Louisiana State University. 500000 B 100000 C 1000000 D. Some of the usual and typical provisions in most Personal Umbrella Policies are.

The first insuring agreement is. Generally speaking most umbrella insurance will start with 1 million in coverage and increase in million dollar increments up to 5 million. To insure up to 1 million of additional liability costs between 150 and 300 annually.

Here are some average quotes I found after checking three insurance carriers. Umbrella policies usually provide roughly 1 million to 5 million of additional coverage and it is possible to get more if you have lots of assets to protect. What type of policy can broaden coverage and increase the limits of the underlying policies.

You need more coverage than you have assets. Coverage is usually written in increments of 1 million dollars with a single limit per occurrence covering Bodily InjuryProperty Damage and Personal Injury Liability in. Youll need a certain amount of liability insurance in the base policy before you can add umbrella insurance.

We recommend umbrella insurance for anyone with over 300000 of savings. Your umbrella policy pays the remaining 700000 of the judgment plus legal expenses so youre only out-of-pocket 5000 for the 1 million judgment. An umbrella policy can be used to increase coverage or.

Specialized insurance markets for umbrella coverage now can provide 100 million or more of catastrophe limits in a single policy. Your coverage depends upon the premium amount. Your career must have started prior to 1949 if you have worked during a time when.

Umbrella policy rates will be different for everyone. Which increment amount is generally used when writing Umbrella Policies. 3 In addition some insurers use an umbrella policy form that may include the characteristics of both an umbrella and excess liability policyusually by using a bifurcated divided insuring agreement.

The coverage for the umbrella policy generally starts from 150 to 200 for a 1 million policy. For each additional 1 million that you add to a policy the rate will typically go up 50 to 75 per year. Which increment amount is generally used when writing Umbrella Policies.

Businesses in riskier occupations like transportation or construction will pay more for an umbrella than those in low-risk occupations. Legal Expenses What about the legal. What type of policy can broaden coverage and increase the limits of the underlying policies.

For example you might need. An insured and insurer will utilize which of the following when they are unable to agree on the amount of a claim to be paid. Travelers Insurance and Safeco Insurance for instance offer umbrella insurance up to.

Umbrella insurers do not generally drop down and provide coverage over known uninsured liability exposures. 150 190 a year for a 1 million umbrella policy. To own umbrella insurance you must own.

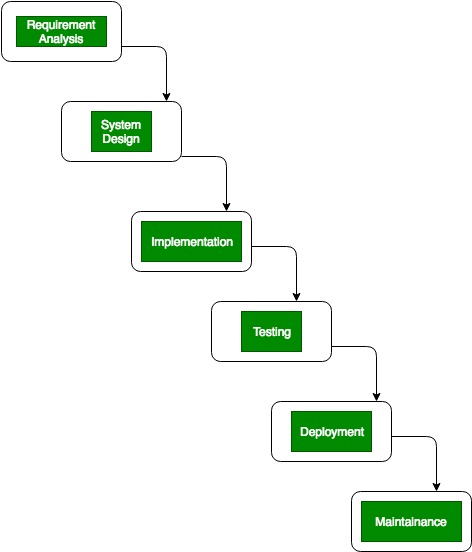

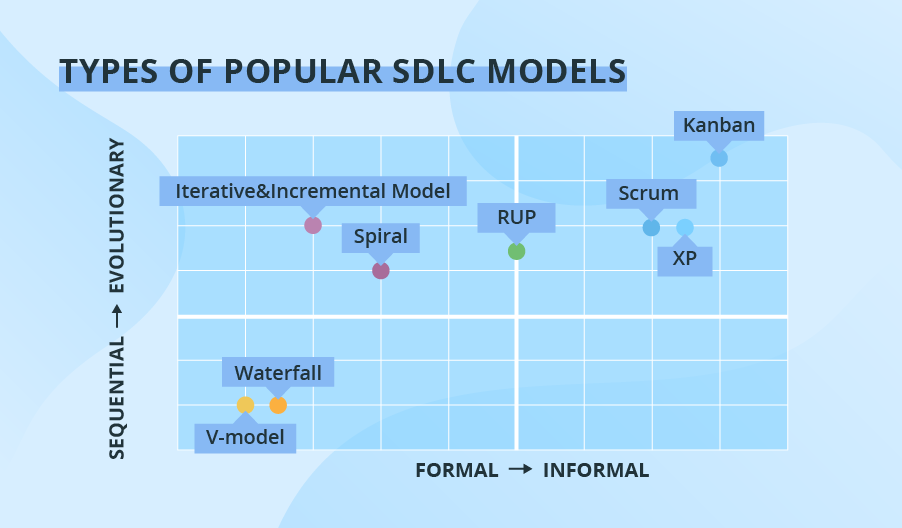

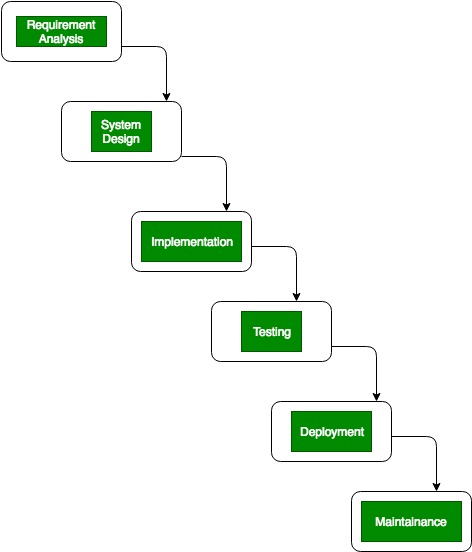

8 Software Development Models Organized In Charts And Explained

Salary Increment Letter Templates 10 Printable Word Samples Formats Forms Lettering Letter Templates Letter Templates Free

Difference Between Waterfall Model And Incremental Model Geeksforgeeks

0 Comments